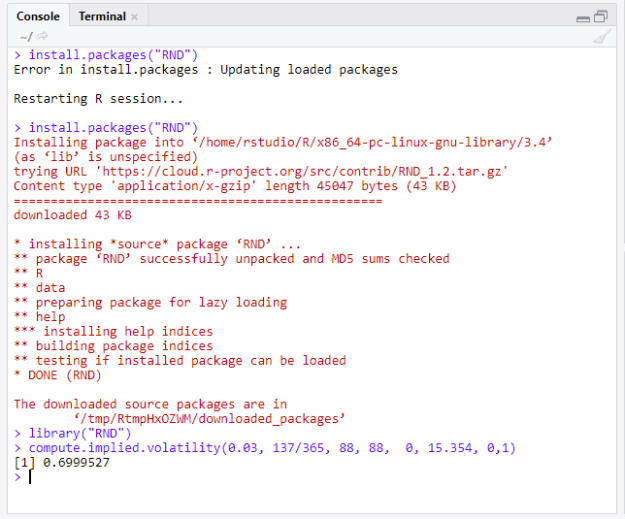

The R package RND computes the implied volatility for a Call option. A sample usage is given as below.

The implied volatility based on the Black-Scholes model differs from realized volatility in that the latter is a retrospective estimate of price, while the former provides insight into the future.

Realized volatility can be derived from more traditional approach like standard deviation and GARCH models. Implied volatility, on the other hand, must be found numerically because the Black-Scholes formula cannot be solved for phi in terms of other parameters. A previous installment provides more mathematical details in TI Nspire.